- Enterprise

- Essentials

How the Automotive Industry is Shifting Gears to Ecommerce

Choose the Right Ecommerce Platform

The automotive industry has changed significantly over the last several decades, as automotive sales across the United States have trended downward and more shoppers have moved to online marketplaces like Carvana.

This trend grew even more pronounced with the onslaught of COVID-19, when lockdowns and global supply chain struggles caused physical car sales to plummet.

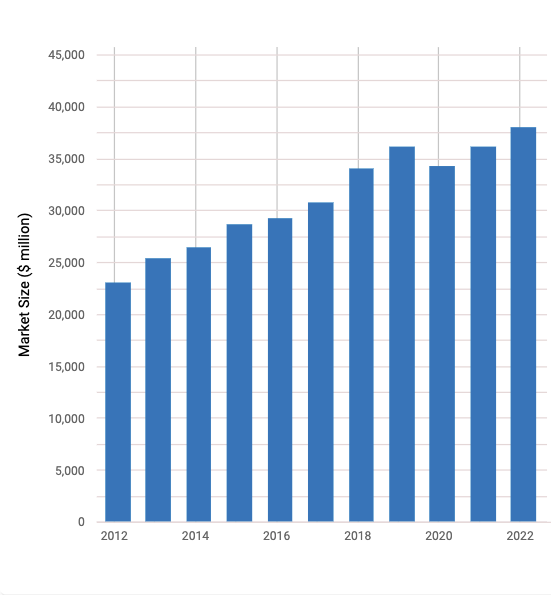

However, despite the drop in overall car sales, the market for automotive ecommerce increased going into 2021 and 2022, as most potential car buyers found themselves with no other option.

Even in 2021, as business began to open up again, the spike in online sales has not subsided as customers have grown accustomed to the ease of ecommerce solutions. Prior to the pandemic, 32% of US car buyers were open to buying online.

That number in 2021? A whopping 61%.

If these numbers are any indication, automotive ecommerce is here to stay. For organizations looking to gain a greater market share, this article can help you stay ahead of the competition.

Automotive ecommerce, or automotive electronic commerce, refers to the buying and selling of automotive vehicles and parts over the Internet. This can be conducted through various methods, ranging from computers to phones to mobile tablets.

Automotive ecommerce doesn’t have to be a siloed process either. An ecommerce sale is often done in conjunction with physical sales. For example, a new car is sold on a physical lot, and its aftermarket parts are purchased on an auto parts ecommerce platform.

Like many other digital commerce industries, automotive merchants are taking an increasingly omnichannel approach to selling, by which customers can use both physical and digital channels to make an educated purchase.

How the Automotive Industry is Shifting Gears Online

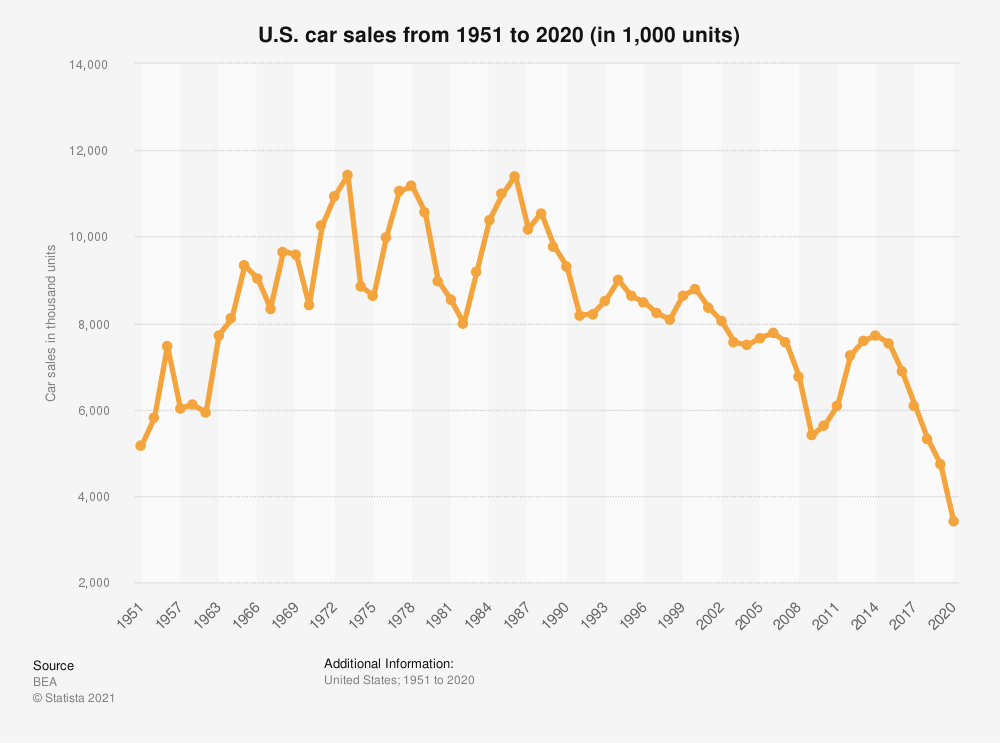

Over the last 20 years, overall total car sales in the United States have declined significantly. In 2000, around 9 million vehicles were sold. In 2020, that number fell to only 3.5 million cars sold.

The low number of 2020 may be indicative of the results of the COVID-19 pandemic, which affected physical sales across every industry. However, as the graph above shows, sales had already dipped substantially in 2019 prior to the pandemic.

Despite the dour news, there is a bright spot for automotive companies — automotive ecommerce. Since 2010, online car sales have skyrocketed, jumping almost 100%.

The numbers speak for themselves, and as a result, the auto industry has shifted its gears even further toward an online model in order to better both sell auto parts and vehicles. Organizations like Ford have prioritized their automotive ecommerce website and social media presences like never before by revamping their websites, focusing on functionality, and prioritizing digital ads.

Benefits of Automotive Ecommerce

As with most industries across the United States, the automotive industry and distributors has been forced to adapt quickly as more and more shoppers continue to purchase online. Automotive businesses that have been hesitant to move away from the tried and true method of physical sales were forced to pivot — whether they were ready or not.

This is a positive shift for organizations, as the benefits of automotive ecommerce stores are substantial — for both the customer and automotive businesses — and can help increase revenue across the entire value chain.

1. A personalized customer experience.

With an ecommerce business model, automotive organizations and dealerships are better able to mold their customer experience in a way that is universal and less prone to salesman-dependent variances.

Through an ecommerce platform, a company is able to improve the buying experience with things such as a personalized ecommerce site or independent storefronts. Through digital and targeted ads, organizations can help point shoppers in the right direction to find the new vehicle or automotive parts they are looking for.

Instead of viewing one car or brand per showroom, customers can simultaneously view cars and compare brands, look through product data and product pages, or even order car parts. All of this is controlled and monitored by the automotive ecommerce platform.

2. Customer base expansion.

Historically, the car dealerships have primarily focused on the local market, with targeted radio and TV advertisements built to get locals to their location.

Ecommerce breaks down the limiting geographic barriers and expands sales across different markets. Instead of a customer having to drive to their local dealership, they can do their car shopping on various websites throughout a region or even the whole of the United States.

An ecommerce model allows automotive companies to expand into new markets and segments, making it easier than ever for a larger audience to shop and buy from anywhere.

3. Cut costs and streamline operations.

Ecommerce has presented a significant shift for automotive companies, not simply in expanding their markets but in changing how they view their own supply chain.

In the classic dealership model, cars sit on the lot until purchased, taking up valuable real estate. Now, however, with an online purchasing model, organizations are able to expand their inventory to include vehicles not on the lot but in a factory itself.

This method allows organizations to cut down on dealerships while saving valuable money in lot space and real estate. It gives customers a broader slew of options when car-buying.

4. Omnichannel selling offers new ways to drive revenue.

The omnichannel approach to sales has reinvigorated many industries across the United States in the wake of the pandemic, and the automotive industry is no different.

As opposed to siloed efforts of a local dealership or even an online shop, the omnichannel model blends the two in synchronization. A customer interested in a vehicle can view it online and, before purchasing, set an appointment to test drive the car on-site.

This ultimately gives both the customer and the dealership more options along the path to conversion, raising potential revenue and elevating the user experience.

Top Automotive Website Examples

Below are eight automotive brands focused on creating exceptional customer experiences by designing ecommerce sites that drive sales, revenue and market share.

How to Boost Automotive Ecommerce Sales

The automotive ecommerce approach is rapidly growing more attractive for organizations that have historically depended on physical locations. As they move into the digital space, it is critical that automotive companies know how and where to reach their target audience to get the message out.

1. Social media.

Social media is an ever-present force in American society today. By creating pages on different social media sites like Facebook and Instagram, organizations can increase awareness of their products and build engagement.

Engagement is the name of the game. How often does a car company show up on someone’s feed? If an organization can make a name for itself through social media, whether through word of mouth or quality customer service, it’ll eventually see that bleed into its sales.

2. Digital ads.

Digital advertising has changed the ways things are sold on the internet and can make or break a company’s ventures online.

Vehicles can be advertised and displayed through digital ads, whether on Google, Bing, or social media. With targeted marketing, if someone searches for anything related to a specific vehicle or brand, an ad will appear in front of them. This can lead not only to quick sales but can strengthen a brand’s overall reach.

3. Integrating into Marketplaces.

An organization looking to push into online marketplaces doesn’t need to begin from ground zero.

By using currently existing marketplaces such as Amazon, Walmart and Ebay, automotive companies can take advantage of a customer base on platforms already proven to succeed.

4. Customer reviews.

Even in online spaces, word of mouth is essential, doubly so for an organization that is just beginning its online journey.

An automotive business that is proud of the work it does can use customer reviews as an outlet to highlight what the company brings to the table and the quality of its customer service.

5. Virtual showrooms.

Another result of COVID-19 is the growth of virtual showrooms. Before the pandemic, showrooms were a valuable place to promote vehicles.

With a virtual showroom, organizations can combine the best of the physical dealership and the online stores. By integrating splashy images that highlight the visual appearance, alongside vehicle specifications, automotive companies can bring vehicles to life at the push of a button.

The Final Word

The move within the automotive industry into the world of ecommerce is not a new event but a gradual shift that has been a long time coming.

In an AutoTrader Car Buyer of the Future Study, more than 99% of customers declared that they were dissatisfied with the current automotive buying process.

This data highlights the changes that have been needed in the automotive marketplace. If anything, the pandemic may have served as the final push that many automotive organizations needed to innovate and modernize the way that they sell their products and reach customers. With over 60% of retail sales in 2022 predicted to be ecommerce-based, the automotive shift online couldn’t have come at a better time and will enable this historically innovative industry to continue evolving.