- Enterprise

- Essentials

How Buy Now, Pay Later is Transforming Online Shopping

TABLE OF CONTENTS

Buy Now, Pay Later (BNPL) is a solution for point-of-sale financing that has grown increasingly popular in recent years, particularly among the younger generations.

BNPL solutions emerged in the early 2010s to address the pain points around financing — namely, complexity and credit cards with high fees and APRs.

As shown in a study by Insider Intelligence, these often exorbitant fees have led consumers to look elsewhere for payment methods, directly leading to the success of BNPL.

The COVID-19 pandemic exacerbated many pre-existing issues of financial stress, including missed payments and shrinking credit limits. Partially due to this, the overall usage of credit cards in the United States has declined over the past several years, leaving an opening for different payment methods to emerge — one that BNPL took advantage of.

As an alternative option to credit cards and other forms of financing, BNPL solutions were designed to allow shoppers to purchase their product and pay in a predetermined number of installments over time. These solutions are often offered to customers with little to no interest rates and hidden fees, meaning no additional cost to the customer.

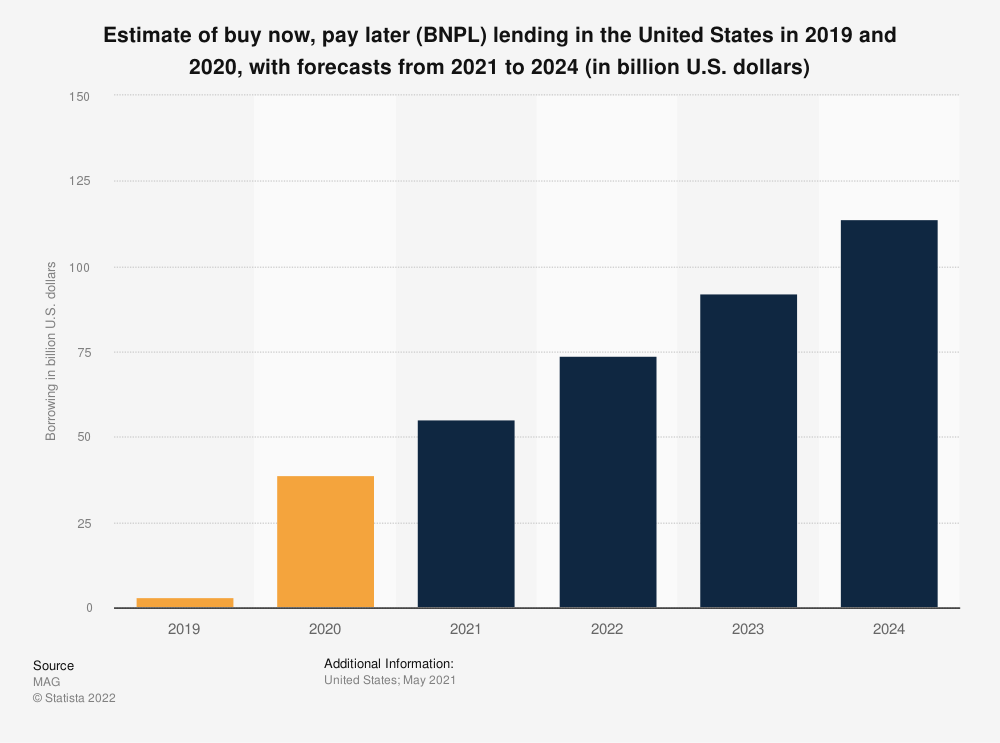

The size of the U.S. BNPL lending market was worth around a few billion U.S. dollars in 2019 but is estimated to grow by 1,200 percent by 2024.

With the rapidly growing implementation of BNPL solutions, retailers looking to gain an edge in the market are presented with a real opportunity — they just have to jump on it.

Who is the target customer for BNPL?

Historically, the target market for BNPL has been the younger generations, Millennials and Generation Z.

According to a study by Forbes, the growth of BNPL among Gen Z has grown 600% since 2019, while the rate for Millenials has more than tripled.

While Gen X and Baby Boomer adoptions aren’t too far behind, the growth of BNPL among the younger generations points to a future where BNPL no longer exists as an alternative payment method but the primary one.

How Does BNPL Work?

At checkout, shoppers will typically have the option to receive their product right away but to pay for it either in full after 30 days or in smaller installments over time.

They typically make three or four equally spaced installment payments, taken directly from their payment card. Either way, there are no extra fees or interest to pay, provided they pay on time.

Participating merchants pay the provider 2–6% commission plus a fixed fee for every transaction.

Buy Now, Pay Later payment options.

Though the exact details vary by country, most BNPL services offers customers three basic options:

- Pay Later in full after 30 days.

- Pay Later Installments into 3 or 4 equal, interest-free installments.

- Finance It, splitting the cost of larger purchases into as many as 36 monthly payments. Interest charges can apply.

The Buy Now, Pay Later checkout experience.

Consider the BNPL experience from the customer’s perspective. They find an item they like, add it to their basket and click checkout. So far, so normal.

However, here’s where things get interesting.

Alongside traditional payment options like credit/debit cards and PayPal, they’ll see options such as Pay with Sezzle and Pay with Klarna.

Close to the fields to enter their card details, shoppers are presented with the option to buy now, pay later — opening up consumer purchase flexibility through several flexible payment options.

Pay Later at the point of sale.

In some countries, customers can order a physical or virtual BNPL card, allowing them to buy now and pay later from retailers who do not typically offer this option. Purchases are charged to their account with the opportunity to pay immediately in 30 days or via financing.

Though most BNPL transactions are with online retailers, traditional brick-and-mortar retailers can also offer BNPL payment plans. This option usually involves the customer generating a QR code within their BNPL app, which is then scanned at the point of sale. The retailer gets the credit and the customer gets to pay later.

Choosing how and when they pay — without accruing interest — can increase spending power and allow customers to determine their financial schedules.

Why Do Consumers Like Buy Now, Pay Later?

As BNPL grows in popularity as a payment solution, businesses must understand why consumers like BNPL and how they can best position themselves to take advantage of it.

Credit card use is on the decline.

Since the beginning of the COVID-19 pandemic, customers have been slowly moving away from the dominance of traditional credit cards, with factors such as high-interest rates, declining credit limits and poorly implemented rewards programs exacerbating the issue.

The decline of credit cards presents an opportunity for alternative payment methods, including Buy Now, Pay Later.

It’s a more affordable way to finance purchases.

Unlike credit cards — which make their money off of interest rates and late fees — the BNPL options provide a more affordable payment option since they typically have limited fees and interest rates.

Buy now, pay later is a more convenient and flexible way to buy.

For consumers who are wary of credit cards and typically don’t carry cash, BNPL offers a convenient, flexible payment option.

If you’re currently at a store, payment approval is instantaneous. If you’re looking to order items for a later date, BNPL works as well, allowing you to pay upfront to ensure on-time delivery without any payment hassles or forgetfulness.

Discover the Future of Ecommerce

Download our report for an in-depth analysis of consumer shopping trends — from data privacy and sustainability to cryptocurrency and shopping on the Metaverse.

Access NowHow Using BNPL Options Benefits Retailers

Retailers want to get paid right away, even if their customers want to spread the cost. A BNPL supplier like Klarna, Affirm or Sezzle will immediately transfer funds to the retailer upon a customer’s purchase.

The use of smart algorithms allows these companies to assume credit risk for both the retailer — paying them even if the consumer defaults — and the consumer.

Whatever happens, everyone is protected.

Here are some of the specific benefits retailers will enjoy by implementing a BNPL option:

Attracts new customers.

The ability to try before you buy has long been a problem for online retailers — people like to feel the fabric between their fingers and see if the shoes fit before committing. Buy now, pay later specialists offer a great chance to make this work in the online space.

Through features like free returns and dedicated support staff, organizations using BNPL can lower entry barriers for consumers and give them flexibility when making purchases.

It’s easy to see offering free returns as a cost sink, but they are becoming an essential business tool.

According to a UPS study, 66% of customers say they check return policies before purchasing, and more than half of online shoppers will steer clear of stores with a strict returns policy.

Businesses that see returns as a chance to build better relationships with their customers are better placed to succeed.

Better customer experience.

While it may be true that Millennials and Gen Z love shopping, browsing and uncomplicated delivery, like everyone else, they demand and expect a superb shopping experience.

If you want to get the younger generations and keep them as customers, you need to build a platform that is up to the task. That has to come before you even start thinking about reward programs, loyalty schemes or any other nice to haves.

Increased sales.

Whether it’s the shock of such a big chunk of change leaving your bank account, or the prospect of high interest rates on your credit card, it can be challenging to purchase a big-ticket item. That, in part, is why BNPL is having a positive impact on conversion rates.

The Baymard Institute found that the most commonly cited reason for cart abandonment was the price. Offering installment options can reduce the sticker shock significantly, encouraging shoppers to complete their purchases.

Higher customer lifetime value (LTV).

BNPL is ultimately a win for consumers in that it gives them more flexibility and more control of what and how they buy. Merchants attract new Millennial and Gen Z customers, get more repeat visits and convert higher average basket sizes.

Since a positive purchase experience is essential to customer retention, these positive experiences mean they’ll come back again and again. In addition, once they know you offer a BNPL option, they’ll come back to you for their next big-ticket item.

How to Choose the Right Buy Now, Pay Later Provider

When looking for the right BNPL provider, you must first understand what types of items you intend to sell, pricing and most importantly, who your customers are.

Once you have that under control, the following options are critical to selecting the right BNPL provider for your business.

Repayment terms.

BNPL organizations typically offer multiple installment plays and term lengths, from a couple of weeks to several years.

When reviewing your business and which repayment options work best for you, it is crucial to determine your average order value (AOV).

If you have a high AOV, BNPL providers that offer repayment over a lengthier period, ranging from several months to years, are likely to be your best choice. However, if you have a lower AOV, it may be in your best interest to look for plans with fewer installments over a shorter amount of time.

Credit limits.

Most BNPL providers have minimum and maximum credit limits. Before selecting a provider, make sure to evaluate your business credit limits and your AVO to determine what works best for you.

Geographic locations served.

Which provider you choose may be dependent on which market you are located in or operate out of. This can include using multiple providers for different markets, depending on your budget and access.

Buy Now, Pay Later Providers

Competition is growing within the BNPL marketplace, giving businesses and consumers more options.

The following highlights some of the leading BNPL providers and their current capabilities:

Klarna.

Klarna is a Swedish financial technology company that has become one of the major players in the BNPL sphere, partnering with many businesses in almost 20 countries — including BigCommerce.

Repayment Options

Pay in four installments, with one interest-free payment every two weeks.

Credit Limit and Fees Associated

Klarna does not have a predefined spending limit. Each time someone uses the solution, a new, automated approval decision is made concerning the limit.

Klarna does not have annual fees. However, some services may incur additional costs, including late and late return fees.

Sezzle.

Sezzle is an American financial technology company located out of Minneapolis. Like Klarna, it is a swiftly growing company partnering with over 47,000 brands.

Repayment Options

Split purchases into four equal payments, collected over a six week span.

Credit Limit and Fees Associated

Sezzle's max limit is determined by an automated system that considers a variety of factors during approval. If you're a first-time user of Sezzle, you may not receive a high limit, though you can eventually raise it with continued usage of the service.

There are no hidden fees or interest rates with Sezzle. However, if a payment fails or is not completed on time, there are late fees that can affect future payments.

PayPal Pay in 4.

PayPal has recently entered the BNPL sphere with Pay in 4. With this, Paypal is providing its current customers with an alternative payment plan while opening itself up to even more consumers.

With millions of online stores already partnered with PayPal, the company is leveraging its brand name and connections to swift success.

Repayment Options

Four interest-free payments every two weeks, with no impact to your credit score.

Credit Limit and Fees Associated

Pay in 4 is available for purchases between $30 and $1,500.

Like other services, all payments are interest-free. However, PayPal will charge a late fee for a late payment, with the amount dependent on the state of residence.

Affirm.

Affirm is a publicly-traded fintech organization working out of San Francisco. It built its business model to support small, everyday purchases and focus primarily on the consumer.

Repayment Options

Pay in four, interest-free installments. Repayment terms range from bi-weekly to monthly, depending on the size of the purchase.

Credit Limit and Fees Associated

Affirm’s BNPL option is available for purchases up to $17,500. There are no hidden fees or interest charges associated with Affirm. However, unlike other payment providers, they do not charge late fees — though they can still harm your credit score.

Buy Now, Pay Later in Ecommerce

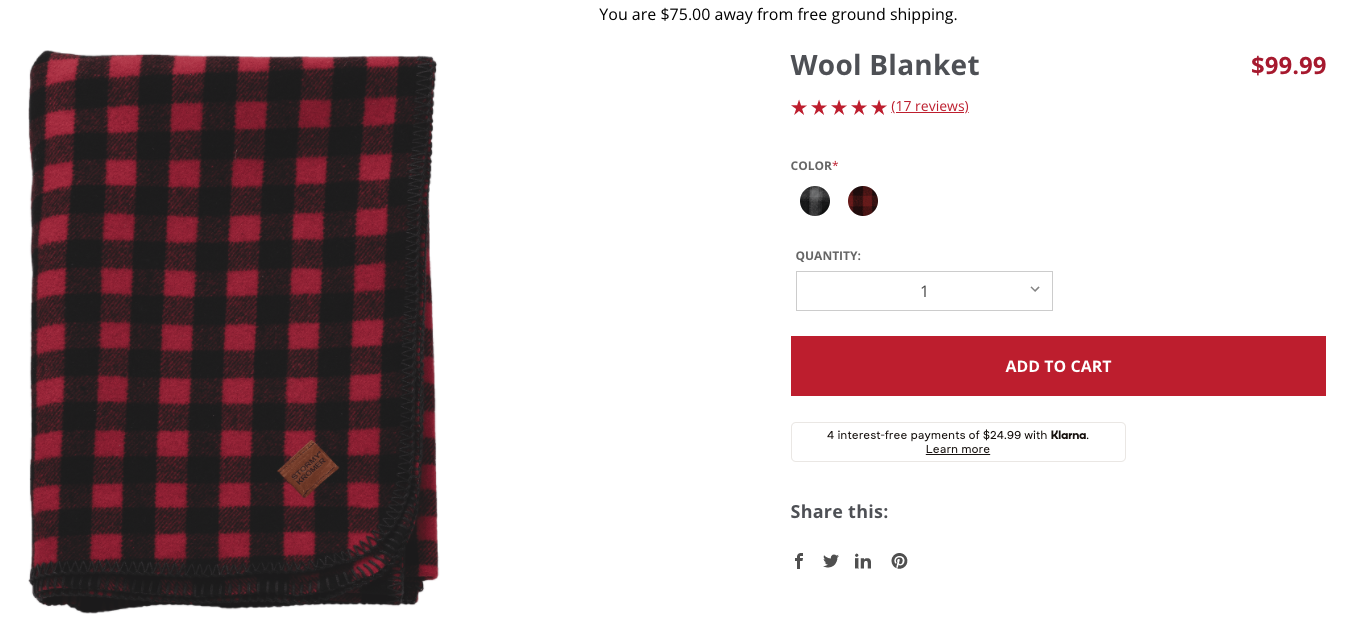

Merchants worldwide are giving their shoppers the option to pay over time. Here are a few more BigCommerce customers making Klarna’s BNPL option work for them.

Stormy Kromer.

Stormy Kromer, headquartered in Michigan, leverages Klarna, putting the BNPL provider’s banner just underneath the Add to Cart button.

Source: Stormy Kromer

The Final Word

As the younger generations begin to come into their own and gain further purchasing power — and as credit cards continue to decline in popularity — expect the desire for flexible payment options to increase.

Buy Now, Pay Later presents an alternative, flexible option to disrupt the payments industry, steal customers away from credit card companies and enable them to spread purchase payments over time — without the uncomfortable interest fee accrual.

Digital financing options will only continue to grow alongside an increasingly technological world. For organizations who want to remain on the cutting edge — and meet a changing customer base — implementing Buy Now, Pay Later into a storefront can only serve to benefit you.

FAQs About Buy Now Pay Later Ecommerce

Where did BNPL start?

BNPL has existed as a concept for many generations, with postponed payments existing as an attractive option as opposed to payment up front.

However, the recent iteration of BNPL came into form in the early 2010s, with companies like Affirm and Klarna emerging in Europe and Afterpay in Australia.

What Buy Now, Pay Later providers does BigCommerce work with?

BigCommerce is proud to work with several BNPL providers, including both Affirm and Sezzle.

Furthermore, BigCommerce has a partnership with Klarna, allowing businesses to combine its ecommerce capabilities with the Klarna financial system.

Should I offer Buy Now, Pay Later on my website?

If you’re capable, then this answer should be an easy one — absolutely.

As BNPL continues to grow in popularity, retailers and other organizations that do not provide it as an option face the prospect of falling behind. The fact of the matter is, why wouldn’t you? BNPL works to give both your business and your customers greater purchasing flexibility.

Why is Buy Now Pay Later so popular?

As mentioned above, BNPL has grown as a payment method due primarily to dissatisfaction with credit cards and the often inhibiting fees surrounding them.

This is especially true with the younger generations, as Millennials and Generation Z have become disillusioned with the financials surrounding credit cards, preferring options like BNPL, which offer greater flexibility, increased payment schedules and significantly lower fees.