- Enterprise

- Essentials

Finding the Best CBD Payment Processors to Capitalize on Profit Potential

Please note: All references to "CBD" or "CBD products" within this post refer to hemp-derived CBD, not marijuana-derived CBD.

If you're looking for a way to sell your CBD products online, chances are you already know about cannabidiol and its rising popularity in the health and wellness world.

An influx of online businesses has begun introducing CBD into their ecommerce stores. As an industry poised to harvest $16 billion in revenue by 2025, is it any wonder why?

Since the passing of the 2018 Farm Bill, an increasing number of ecommerce business owners have been searching for payment gateways that allow CBD merchant processing.

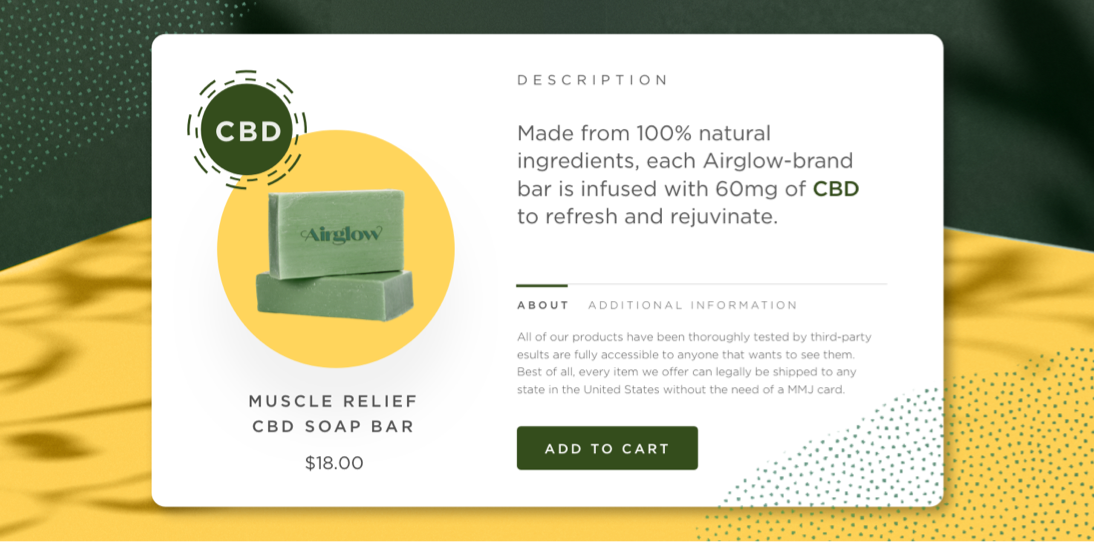

In an effort to meet consumer demand for CBD products, such as oils, capsules, supplements and topical solutions, the non-psychoactive cannabinoid is being stocked inside an ever-growing number of brick-and-mortar shops and online stores.

With the CBD therapeutics segment alone on track to earn $9.30 billion in 2026, growing at a CAGR of 27.4%, this industry has significant revenue potential. However, getting involved in such a high-risk sector means that you'll need to know the ins and outs of conducting CBD business transactions legally.

What is CBD?

Cannabidiol, widely known as CBD, is a popular natural substance reportedly used to help with many conditions. It is typically added to tinctures, edible foods like gummies, oils and body products like balms and lotions.

Unlike THC (tetrahydrocannabinol), the primary mind-altering substance in the cannabis plant, CBD is non-psychotropic. The cannabinoid can be extracted from both the hemp and marijuana plants, with industrial hemp plants proving to be the most popular for CBD extraction.

CBD Requires High-Risk Payment Processors

Although it is legal in most forms throughout much of the U.S., CBD is still considered a high-risk industry. The FDA is straightening out the regulatory framework for this industry, with the majority still unclear.

As long as you are prepared, you should be able to dodge potential financial predicaments and find success with your online/offline CBD store. However, you cannot ignore that CBD's strict regulation puts all products containing the cannabinoid in a high-risk category.

As a result, many payment processors will be reluctant to work with CBD companies.

The solution? Find a high-risk processor who is not afraid to assist you with a payment gateway that ensures you can conduct business just like any low-risk company.

CBD Payments: The Basics

Before getting into the details of purchasing a CBD payment processor, it is important to understand the basics surrounding CBD payments:

Processor.

When starting your CBD businesses, the first thing to understand is what payment processors you will be able to use, as many have struggled in the past with a lack of processors, POS systems and even restrictive contracts.

Remember, the more options you can offer your potential customers, the greater your opportunities. There are many payment processors out there now specializing in CBD payments — you simply have to select one.

Gateway.

A payment gateway is a merchant service provided by an ecommerce application service provider that authorizes credit card payments or direct payment processing.

If you’re looking to sell CBD, you will need to find a payment gateway that can handle high-risk products. This may include additional fees, but it will prevent you from the possibility of a random removal.

Bank.

The 2018 Farm Bill did not fully legalize all forms of CBD nationwide. Because of this, laws surrounding CBD and how it can be processed differ from state to state.

With its legal status often in dispute — and with the product itself being considered high-risk — there are still many banks nationwide that refuse to service CBD businesses. When researching payment possibilities, ensure to vet the banks that you plan to use thoroughly.

What to Look for in a CBD Payment Processing Gateway

The worldwide Cannabidiol (CBD) Market is estimated to reach $47.22 Billion by 2028, up from USD 4.9 Billion in 2021.

This substantial growth projection has led to an increasing number of ecommerce businesses scrambling to find a CBD payment processor capable of handling the market — not to mention willing to accept them.

When opening a CBD merchant account, here's what you need to look for:

Can process high-risk transactions.

Your CBD payment processor must be able to deal with high-risk transactions.

Because the industry is relatively new — and hovers around a legal gray area — only a handful of CBD payment processing services will be willing to take risks associated with this type of transaction, such as payment card fraud and charge-backs.

Be on the lookout for a company with extensive experience in aiding businesses operating within a high-risk sector.

Easily integrates with your current platform.

Nobody wants to be forced to switch their ecommerce site to a brand new platform to integrate a CBD payment processor, as it can be incredibly time-consuming and deflating.

It is best to refrain from using a CBD merchant processing system that requires you to use their existing platform. Instead, opt for a company that enables you to integrate their CBD credit card processing system seamlessly with a broad scope of ecommerce software.

Companies that can offer these services are more likely to be capable of supporting you as your company thrives.

A significant portion of CBD payment processors will operate using API integration, which is the most common payment gateway. A major benefit of using API is that a payment gateway of this kind can be monitored by the business owner and provide insight into how an ecommerce store looks from a customer's perspective.

POS availability.

Save yourself time on administrative duties and cut the cost of in-office work by finding a CBD payment processor with point-of-sale (POS) availability.

Processors with POS system integration will be able to assist you in managing both online and offline transactions. With accurate reporting gleaned from POS software, you can increase store profitability, customer loyalty, business intelligence and ease of access to your sales portal.

POS software can also aid you in making lucrative business choices. Moreover, this type of software can be used to control stock input and output from a single location.

Low fees.

When finding a reliable CBD payment processor, you should not be limited to companies that charge a hefty upfront fee. Although more well-established companies may require a fee from account holders upon registration, many will provide their services free of charge or for an affordable rate.

Ask yourself if you can afford to pay the specific percentage your preferred payment gateway will deduct from you for each transaction. If it does not work well with your profit margins, search for a service provider elsewhere.

There are also a number of other fees to take into consideration when selecting a CBD payment processor, such as:

Statement fees.

Compliance fees.

Non-compliance fees.

Terminal fees.

Monthly/annual fees.

Chargebacks may also accrue additional fees — confirm this before establishing a partnership with CBD merchant processing companies.

Reasonable contracts.

Not every payment processor will require you to sign a binding contract to do business. Each company's fees and contracts will differ, so allow yourself enough time to consider which one suits your CBD company the best.

It is advisable to avoid companies that only establish long-term partnerships, particularly if they do not have sufficient testimonials to back up their claims.

If a company catches your eye but only offers a partnership under the condition that you fork over an early termination fee (ETF) if you choose to go elsewhere, be prepared to negotiate.

Customer support.

You must always be prepared for the worst-case scenario when dealing with online and offline transactions for CBD-related products.

For example, suppose a customer wants to issue a $200 chargeback on a recently submitted order. In that case, you need to understand exactly how your chosen CBD payment processor's customer service team will handle these situations. After all, the level of service they provide will reflect on you as a business.

Before you choose a payment gateway, ask a team member how they go about handling disputes, as well as how fraud protection will minimize the chances of disputes arising in the first place.

Personalized customer service is the way to go, but if you cannot find a company that offers this, at least find one that hires a customer service team to manage calls and emails around the clock.

9 of the Best CBD Payment Processors

Competition is stiff in the CBD industry, so you need to be at the top of your game to maximize profit potential and customer retention rates. A CBD payment processor can provide the perfect tailored solution for your business while eliminating the hassles associated with administrative tasks, accounting and business upkeep.

The following top-rated companies have branched out into the CBD industry with their payment gateway services:

Inovio.

Founded in 2016, Inovio is a fairly new payment processing company, though it brings significant experience with payment processors on the back-end.

With an omnichannel-based platform, users can adapt and use any payment experience that works best for them and their business — simplifying a typically complicated process.

Bankful.

Bankful is another recent addition to the payment processing space, founded in 2016. However, the company has quickly separated itself as an innovator in payment technologies.

Bankful has made its name by offering a payment processing platform that can integrate seamlessly with the leading ecommerce platforms, from BigCommerce to Shopify and WooCommerce.

Merrco Payments.

Operated out of Canada, Merrco is a secure payment gateway known for working with both CBD and cannabis in legal regions.

Merrco offers a multi-channel-based service, allowing businesses to sell in-store or online, and processes all major domestic and international credit, debit and prepaid card brands.

NMI.

Presenting clients with a unified commerce strategy, this CBD payment processor supports various payment methods, including ACH, credit cards and debit cards. NMI provides detailed insights into transactions, which can be managed in conjunction with BigCommerce.

In 2021, NMI purchased USAePay, another payment solutions company that was also known for serving as a CBD payment processor.

PayKings.

PayKings is a high-risk payment processor known for advertising specifically to CBD businesses, particularly those with issues with traditional processors.

PayKings is broadly acknowledged as the most well-respected service provider specializing in the CBD industry due to its broad array of services and direct network of over 20 banks and PSPs.

Square.

Square began its move into CBD processing services in 2019. Since then, the company has leveraged its significant financial resources to build out a growing solution in the market.

Square is a great option for both high and low-volume CBD merchants, allowing for growing businesses as well as those who prefer to operate on a cash-only basis.

Easy Pay Direct.

Launched in 2000, Easy Pay Direct is perhaps the most well-established CBD payment processor on the list.

Easy Pay Direct utilizes an EPD Gateway that serves high-risk companies in the CBD, cannabis and hemp industries, as well as low-risk companies in all sectors.

Easy Pay Direct links account holders with credit card processors or domestic banks, depending on their requirements.

BestMerchantRates.

A smaller provider, BestMerchantRates (formerly PayWize) understands the financial predicaments businesses operating in the CBD industry face.

The company may have only started in 2017 but has already provided CBD merchant processing to a long list of CBD oil merchants and medical cannabis dispensaries throughout the U.S.

PaymentCloud.

With its free virtual terminal that enables businesses to track CBD sales easily, PaymentCloud has one of the highest approval ratings of all CBD merchant processing solutions.

Boasting competitive chip, dip and swipe rates, PaymentCloud utilizes third-party processors and collaborates with banking institutions throughout the U.S. to ensure seamless, hassle-free transactions.

Get CBD industry analysis from the experts.

Download The Complete Guide to CBD Ecommerce to learn about industry trends, challenges CBD merchants face online and how to overcome them.

Download NowThe Final Word

Take the time to ask a CBD payment processor about any additional or customizable services that they can offer. Since every company's approach is unique, it is crucial that you can depend on a CBD credit card processing platform for all of your payment needs.

Regardless of your business goals, choosing a CBD payment processor is not a decision to be taken lightly. Dealing with regulatory requirements, fraud protection and data security — not to mention chargeback management — are just a few essential services to be on the lookout for.

This material does not constitute legal, professional or financial advice and BigCommerce disclaims any liability with respect to this material. Please consult your attorney or professional advisor on specific legal, professional or financial matters.

FAQs About CBD Payments

Is CBD legal?

CBD regulations depend on the state where you reside, as certain states prohibit the sale and consumption of CBD. Other states limit the types of CBD products sold in the state or require a specific license.

The legality also depends on whether you want to start selling CBD online extracted from the marijuana or hemp plant and what products you intend to sell. Only hemp products may be sold online if all other state requirements are followed.

Is my current payment processor OK with CBD transactions?

If you are worried, the first step is to reach out to your current payment processor. If they accept payments, then you are golden.

If they answer no, then you should switch to another company as soon as possible. As seen above, there are many companies that specialize in CBD payment processors that can take on your business with minimal transfer fees.

Why are payment processors afraid to process CBD payments?

CBD’s changing legal status by state and its categorization as a high-risk product have led many payment processors to decide that the potential trouble isn’t worth the risk.

Beyond that, there is still the issue of over-promising by CBD businesses, as company merchants tend to overpraise the product’s medicinal benefits — which can lead to fraudulent complaints and even lawsuits.

What is the best payment processor for CBD?

As with most things, it is dependent on your business.

Any of the payment processors listed above can help your business thrive. To decide on a specific platform, you should consider each company’s:

The account approval process.

Pricing.

Contract terms.

Hardware and software specifications.

Customer support.